With more than 9,0001 ASCs across the U.S., outpatient surgery volumes are expected to grow 15% by 20272 indicating new ASCs are still on trend.

But with an aging population and surgeons moving complex cases to ASCs, some previously enjoyed benefits are diminishing.

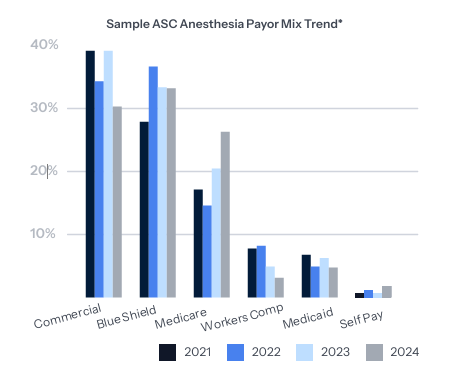

A higher percentage of government insurance payers, lead to longer surgical cases and reduced operating room utilization. Additionally, the need for anesthesia providers has skyrocketed with GasWork.com reporting a 96% increase in demand for anesthesiologists and an 80% increase for certified registered nurse anesthetists since 2020.3 These factors create financial challenges for anesthesia practices that serve ASCs. The table below illustrates a deteriorating payer mix in a sample ASC.

Current ASC challenges

Since the pandemic, anesthesia provider shortages have worsened and costs associated have increased dramatically. Many providers seek fewer working hours and avoid on-call requirements for a better work/life balance, contributing to a shrinking workforce. What once was a profitable venture for anesthesia groups in ASCs has become increasingly challenging.

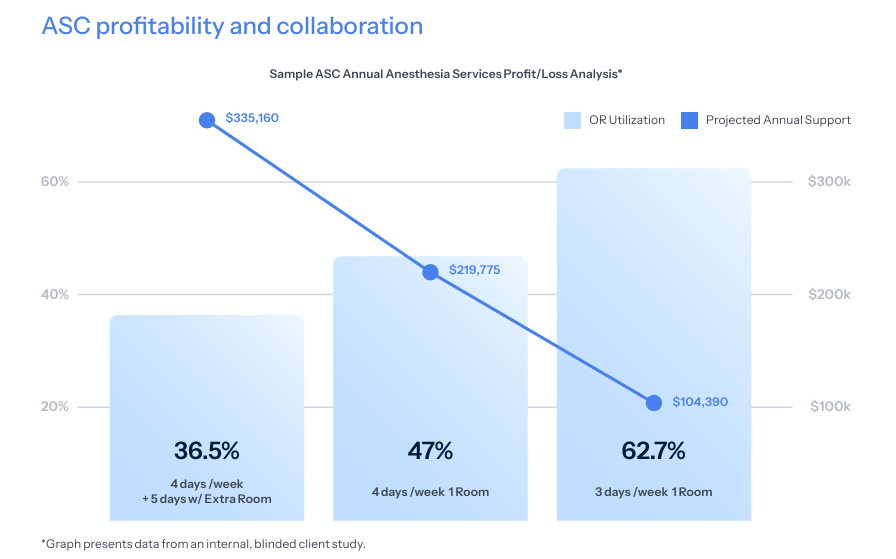

We have found anesthesia groups need either financial support or changes in coverage schedules to continue providing services at ASCs.

When assessing ASC feasibility with anesthesia groups, our team analyzes their business lines and the revenue and costs for each service site. We notice groups often evaluate their profitability on a consolidated basis, rather than recognizing the individual financial performance of each site, leading to poorer performing service sites subsidized by more profitable locations–ultimately threatening the group’s long-term financial sustainability.

Our step-by-step methodology

1. Create an anesthesia staffing model for ASC coverage requests.

2. Assign fair market value (FMV) to each provider type based on regional market trends, work hours, paid time off and coverage hours.

3. Calculate reasonable revenue projections based on case types and payer mix for the ASC, including bad debt allowances.

4. Factor in billing fees and other operating expenses.

5. Prepare a financial pro forma to determine margin versus shortfall for each ASC.

6. Evaluate room utilization and efficiency by day and time.

7. Propose alternative scheduling patterns to optimize revenue while reducing staffing costs.

![[Chart: Sample ASC Annual Anesthesia Services Profit/Loss Analysis]](https://wp.coronishealth.com/wp-content/uploads/2025/12/Screenshot-2025-12-04-102329.png)

Adjusting support strategies

Since anesthesia practices can’t control volumes, payer mixes or rising provider costs, our team has adjusted how we structure ASC support. We recommend a cost-plus model or a room-guarantee model where the ASC must cover the costs of providing services, adjusted for actual cash collections.

This approach encourages the ASC to schedule efficiently and maximize room utilization, containing anesthesia costs and aligning them with revenue generation. As provider costs increase or as the ASC expands coverage, the anesthesia group is protected from additional shortfalls. See the table to see how changes in coverage can contain costs while maintaining capacity and reducing anesthesia service costs.

ASC profitability and collaboration

When managed effectively, ASCs can yield high profit margins within the industry average standards at 25%.4 As trends shift toward ASCs needing to subsidize anesthesia services, it is crucial for ASC leadership, surgeons and anesthesia providers to work together. The Coronis Health team fosters this partnership because greater alignment leads to better support for the overall success of the venture, ensuring long-term sustainability and growth for all involved.

ASCs don’t fail from lack of volume—they fail from operational misalignment. That’s why we start with real data, not assumptions.

Our team of experienced anesthesia-exclusive executive talent provides analysis and support so our clients can enjoy beneficial ASC subsidy arrangements.

Citations:

1. Person (2023) How many ambulatory surgery centers are in the U.S.?, Definitive Healthcare. Available at: https://www. definitivehc.com/blog/how-many-ascs-are-in-the-us

2. Newitt, P. (no date) ASCS to see 25% Surgery Volume Growth by 2032: 5 stats, Becker’s ASC Review. Available at: https://www.beckersasc.com/asc-news/ascs-to-see-25-surgery-volume-growth-by-2032-5-stats.html

3. Joseph A. Rodriguez, D. (2023) Anesthesia alert: Demystifying anesthesia subsidies, Outpatient Surgery Magazine. Available at: https://www.aorn.org/outpatient-surgery/article/

4. Team, T.A. (no date) 7 critical ambulatory surgery center financial benchmarks your accountant should know, The Amblitel Blog. Available at: https://blog.amblitel.com/7-critical-ambulatory-surgery-center-financial-benchmarks-your-accountant-should-know