Rate Setting

By way of background, payments are based on the “relative resources” typically used to furnish the service. Relative value units (RVUs) are applied to each service representing the following components: (a) work, (b) practice expense, and (c) malpractice expense. These RVUs become payment rates through the application of a conversion factor (CF). Geographic adjusters (geographic practice cost indices) are also applied to the total RVUs to account for variation in costs by geographic area. Payment rates are calculated to include an overall payment update specified by statute.

Conversion Factor

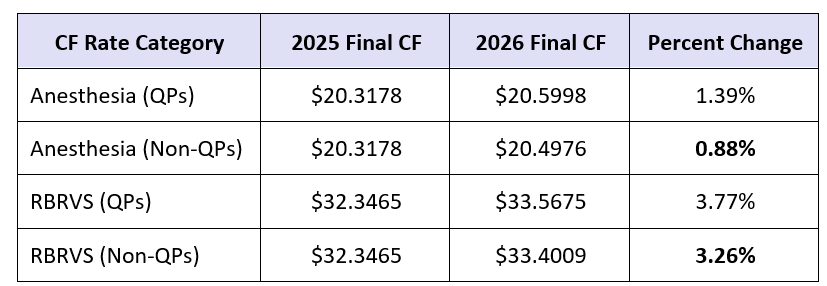

Next year will be the first to witness two separate rates for each of the two CFs: two rates for the RBRVS (non-anesthesia) CF, as well as two for the anesthesia CF. The first rate relative to each CF is to be applied to qualifying alternative payment model (APM) participants (hereinafter known as “QPs”). The second rate for each CF will apply to physicians and practitioners who are not participating in an Advanced Alternative Payment Model (APM). For those who are unfamiliar with APMs, this is the other pathway to participation with the Quality Payment Program (QPP) where the MIPS program is the traditional pathway for anesthesia providers. Most of our readers do not participate in an APM, which means most can ignore the QP CF rates. Nevertheless, here are both rates for both CF categories:

The proposed 2026 RBRVS CF, which applies to non-anesthesia services, is:

- $33.5675 for items and services furnished by QPs, which reflects a 3.77% increase relative to the 2025 CF.

- $33.4009 for items and services furnished by non-QPs, which reflects a 3.26% increase from the 2025 CF rate.

The 2026 anesthesia CF is:

- $20.5998 for items and services furnished by QPs, representing a 1.39% increase from the 2025 anesthesia CF of $20.3178.

- $20.4976 for items and services furnished by non-QPs, representing a 0.88% increase from the 2025 anesthesia CF.

The numbers below, provided by the American Society of Anesthesiologists (ASA), illustrate in chart form the new CFs for 2026:

So, regardless of whether or not you are a QP (participate in an APM), your CF—for both anesthesia and non-anesthesia services (e.g., radiological, invasive line and block placements)—will increase in 2026. But is it enough?

Efficiency Adjustment

According to CMS, “research has demonstrated that the time assumptions built into the valuation of many PFS services are . . . very likely overinflated.” As a result, the rule finalizes the application of an efficiency adjustment to the work RVUs and corresponding intraservice portion of physician time for non-time-based services that are expected to accrue gains in efficiency over time. This would periodically apply to all codes except time-based codes, such as evaluation and management (E/M) services, care management services, behavioral health services, services on the Medicare telehealth list, as well as certain maternity codes. The efficiency adjustment for 2026 is set by the final rule at -2.5%.

According to the ASA, actual payment rates are impacted by a range of proposed policy changes related to physician work, practice expense and malpractice RVUs. CMS estimated these changes in Table D-B7 of the final rule (which does not reflect the CF changes). Impact by practice will vary based on service mix. The table indicates that the policies in the final rule will have a -1% impact on anesthesiology. This negative impact stands in stark juxtaposition to other specialties that are expected by CMS to have a positive impact due to the final rule.

We will have more from the final rule in upcoming alerts that will pertain to topics such as chronic pain, telehealth, quality programs and more.